The One Thing Every Business Needs

This Is the One Thing Every Small Business Owner Needs in Their Toolkit

Do you find yourself wondering how to get a clearer picture of your business’ financial future? You’re not alone.

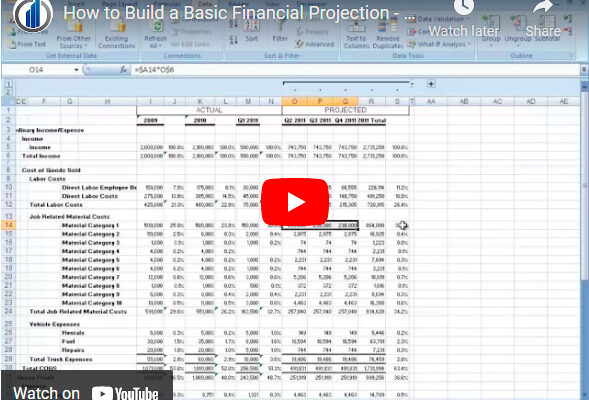

Financial projections are an essential tool for any small business owner, but they can be challenging to put together. Fortunately, with the right software and guidance from experts, it doesn’t have to be daunting! In this post, we’ll cover why you need financial projections to make better-informed decisions about your business, and what tools are available that will help simplify the process.You can Project Victories FREE Financial Planning tool HERE!!

Why do you need them?

Financial projections can help you understand your business’ current financial standing. However, more importantly, they can help you create a vision for where you want your business to go and check if it’s realistic within your current plans.

It’s essential to understand where your business stands financially so that you know when it’s time to take action and make changes. However, don’t forget about projecting out even further than just one year, so you don’t lose sight of your long-term goals!

Key financial statements:

- Balance sheet. This statement is like a photograph of your company at a certain point in time. It tells you everything you have and how you are paying for it, whether through loans or equity.

- Profit and loss. This tells you basically how much money you’re making with your company. However, most people tend to only look at the profit and loss in the past year, whereas by projecting into the future, you can see how much money you can potentially make with your company.

- Cash flow. One that is often missed but critical. If your business makes a good profit but doesn’t have the cash to pay employees and suppliers because of the timing of payments coming in and out, it could lead to bankruptcy.

How to create them:

- Use the right software. Excel can be enough if you’re handy with the formulas, and other accounting software has useful templates you can reuse.

- Get data for estimates. The more data you have about your business, the market, the consumers, and the competition, the easier it will be to create solid financial projections.

- A projection is a forecast of what the future might look like based on current data and assumptions about what could happen in the future. It’s not going to be a certainty, but it’s enough to help you think through where the risks and opportunities for your business lie.

Keep finances in check

If your financial projections reveal cash flow issues, look for ways to lower your operating costs. Hire freelancers instead of full-time employees, renegotiate with vendors, and buy in bulk. If you need to revamp your marketing plan, save by taking advantage of free tools like an online logo creator to make a logo. You’ll be able to create a compelling and recognizable logo by choosing a professionally designed template and customizing it to your design specifications.

Creating a financial projection is not always something you want to do, but it is necessary. It may sound like an overwhelming task, but with some time spent planning and finding a template online or from another source that fits your needs, you might find that you even enjoy it!

Your path to business success.